Looking for the top Fabricação PCB Brasil? Discover the top 10 PCB factories in Brazil, learn how to choose reliable suppliers, shorten lead times, cut hidden costs, and prepare Gerber files.

Top 10 Fabricação PCB Brasil List

| Company | Main Business | Advantages | Production Capability | Lead Time |

| EBest Circuit (Best Technology) (Global Factory) | Full-process PCB + PCBA | ISO9001, ISO13485, IATF16949, AS9100D; MES traceability; tight tolerance; RF and high-performance boards | 1–50 layers (100L with review); FR4, high-Tg, Rogers, ceramic, metal core; microvia; heavy copper | PCB: 3–7 days; PCBA: 7–15 days |

| Circuibras | Single-layer, double-layer, multilayer PCB | Strong domestic presence; stable standard builds | 1–12 layers; FR4; simple HDI | 7–12 days |

| Tecnotron | Industrial PCB manufacturing | Good handling of commercial-grade products | 1–10 layers; FR4, halogen-free | 8–14 days |

| Micropcb | Prototype and small batch | Fast proto support | 1–8 layers; FR4; basic impedance | 5–10 days |

| Multicircuitos | Rigid PCB fabrication | Local service support | 1–12 layers; FR4; HASL, ENIG | 7–12 days |

| Atron | Industrial applications | Good for telecom and control boards | 1–10 layers; FR4; controlled processes | 8–15 days |

| Fumax | Eco-friendly PCB solutions | Global supply chain, recycling programs | 2-6 layer PCBs, RoHS-compliant materials | 4-9 days |

| CircuPress | Consumer electronics PCB | Clear communication; simple builds | 1–6 layers; FR4 | 7–10 days |

| Fuchs Electronics | Automotive and industrial electronics | Strong testing flow | 1–8 layers; FR4; AOI | 10–15 days |

| Wtech PCB | Medium-volume fabrication | Friendly support for repeat orders | 1–10 layers; FR4; ENIG | 8–14 days |

How to Choose A Reliable PCB Factory in Brasil?

Below Is A Detailed Selection Guide to PCB Factory in Brasil:

1. Precise Verification of Production Capacity

- Monthly production capacity must be ≥50,000 square meters, equipped with LDI exposure systems (accuracy ±10μm) and AOI inspection equipment, supporting 24/7 three-shift production. Based on Brazil’s industrial capacity utilization rate of 78.2%, prioritize manufacturers with capacity utilization rates above the industry average to ensure emergency order delivery capability.

- Evaluate shift flexibility: Support 7×24 production scheduling, emergency order response time ≤48 hours, and avoid overloaded manufacturers (order backlog rate <5%).

2. Strict Quality Certification and Standards Compliance

- Mandatory ISO 9001:2015 certification and IPC-A-600 standard compliance required. Defect rate <0.3%, first-pass yield >98%. Environmental compliance must meet Brazil’s INMETRO certification, with energy efficiency labels reaching Class A.

- Prioritize manufacturers with automotive-grade IATF 16949 certification for high-reliability scenarios (e.g., automotive electronics, medical devices), requiring defect rates <0.2%.

3. Technical Expertise and Innovation Evidence

- Evaluate R&D investment ≥5% of revenue, patent portfolio ≥10 patents (e.g., Zhuhai Longyu Technology’s “automatic cutting device” patent). Support HDI boards (line width/spacing ≤75μm), flexible circuits, and rigid-flex boards with ≥20 layers.

- Assess rapid prototyping capability: Small-batch trial production cycle ≤7 days, design change response time ≤24 hours, adapting to agile development needs.

4. Localized Supply Chain and Logistics Efficiency

- Prioritize manufacturers in industrial hubs like São Paulo and Rio de Janeiro, with local material sourcing ≥70% and supply chain resilience score >85 (based on Brazil’s local supply chain maturity assessment).

- Domestic transportation time ≤3 business days, air freight line time 8-12 days (e.g., GYXY Logistics), sea freight 45-55 days, ensuring regional distribution efficiency.

5. Customer Reputation and Case Verification

- Reference Brazil’s local customer reviews: On-time delivery rate ≥99%, after-sales response time ≤24 hours. Verify industry benchmark cases, such as “Supplying 100,000 PCB boards to Brazil’s largest automotive electronics company with 99.5% on-time delivery.”

- Avoid manufacturers overly reliant on international suppliers; prioritize partners with localized service capabilities (e.g., GAC Group’s Brazil R&D Center case).

6. Cost Efficiency and Contract Transparency

- Compare quote transparency: Long-term partners enjoy 5% discounts, payment terms support 30-day credit. Prioritize manufacturers offering customized solutions (e.g., small-batch trials, special material handling) to fit project needs.

- Evaluate hidden costs: Material storage capacity ≥10,000 square meters, avoiding import dependency risks (e.g., domestic copper-clad laminate localization rate ≥45%).

7. Regulatory Compliance and Risk Management

- Confirm manufacturers familiar with Brazil’s import regulations (e.g., 35% tariff), tax policies, and labor laws to mitigate legal risks. Assess intellectual property protection: 100% confidentiality agreement signing rate, patent infringement rate <1%.

- Prioritize manufacturers with international collaboration experience (e.g., joint production with Asian/European partners) to expand global resource networks and reduce geopolitical risks.

What Are Types of Fabricação PCB Brasil?

- Single-Sided PCBs

- Double-Sided PCBs

- Multi-Layer PCBs (4-24+ Layers)

- HDI (High-Density Interconnect) PCBs

- Flexible PCBs (Flex)

- Rigid-Flex PCBs

- High-Frequency/High-Speed PCBs

- High-TG (Glass Transition Temperature) PCBs

- Metal-Core/Aluminum PCBs

- Thick Copper PCBs (Up to 12 oz)

How to Shorten the Lead Time of Fabricação PCB Brasil?

Guide to Shortening the Lead Time of Fabricação PCB Brasil:

1. Deep Integration of Localized Supply Chain

- Prioritize manufacturers in industrial hubs like São Paulo and Rio de Janeiro, with local material sourcing ≥70% and supply chain resilience score >85 (based on Brazil’s local supply chain maturity assessment). For example, São Paulo manufacturers leverage mature electronic industry clusters to shorten material procurement cycles by 40% and achieve emergency order response times ≤48 hours.

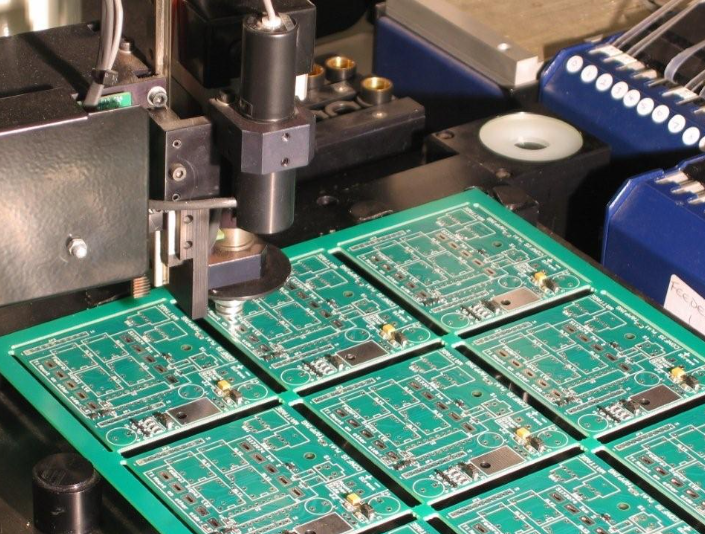

2. Full Coverage of Automation Technology

- Deploy LDI exposure systems (accuracy ±10μm), AOI inspection equipment, and SMT production lines, integrated with ERP systems for production process visualization. Take Micropress as an example: high-precision equipment enables 8-hour rapid production, 95% on-time delivery rate, defect rate <0.3%, and reduces production cycles by 60% compared to traditional processes.

3. Rapid Prototyping and Agile Development Support

- Select manufacturers supporting small-batch trial production (cycle ≤7 days) and design change response ≤24 hours. For instance, a Brazilian manufacturer delivered 100,000 PCB boards to an automotive electronics client with 99.5% on-time delivery, shortening the industry average by 15 days through agile development workflows.

3. Logistics Network Optimization and Transportation Efficiency

- Choose manufacturers near transportation hubs (e.g., São Paulo International Airport) with air freight transit times of 8-12 days, sea freight 45-55 days, and domestic transportation ≤3 business days. PCI Paraná, for example, optimized its logistics network to compress inter-state transportation time to 2 days, saving 30% compared to traditional logistics.

4. Strict Quality Control and Standards Compliance

- Mandate ISO 9001:2015 certification and IPC-A-600 standard compliance, with defect rates <0.3% and first-pass yields >98%. Environmental compliance requires Brazil’s INMETRO certification and Class A energy efficiency labels, ensuring adherence to Brazilian environmental regulations and international standards.

5. Customer Collaboration and Case Verification

- Reference Brazil’s local customer reviews, with on-time delivery rates ≥99% and after-sales response times ≤24 hours. Verify industry benchmark cases, such as “Supplying 100,000 PCB boards to Brazil’s largest automotive electronics company with 99.5% on-time delivery,” demonstrating the manufacturer’s lead time control capabilities in high-end scenarios.

7. Regulatory Compliance and Risk Management

- Confirm manufacturers’ familiarity with Brazil’s import regulations (e.g., 35% tariffs), tax policies, and labor laws to mitigate legal risks. Evaluate intellectual property protection measures, including 100% confidentiality agreement signing rates and patent infringement rates <1%, ensuring design security and commercial confidentiality.

How to Reduce the Hidden Production Cost of Fabricação PCB Brasil?

Guide to Reducing Hidden Production Cost of Fabricação PCB Brasil:

1. Design Optimization: Lock in 70% of Costs Upfront with DFM

- Follow local manufacturers’ process capability parameters: Before PCB submission, actively obtain and compare the factory’s standard process capability chart. For example, widening trace width/spacing from 3/3 mil (0.076/0.076mm) to 4/4 mil (0.10/0.10mm) reduces scrap rate risk by ~10%; increasing drill hole diameter from 0.2mm to 0.3mm cuts drill bit breakage probability by 20% and associated special processing fees.

- Limit customization of materials and processes: Adhere to 1.6mm-thick FR-4 standard Tg (140°C) substrates. Use high-frequency substrates (e.g., Rogers) only for RF/high-temperature applications—they cost 3-5x FR-4. Non-green solder mask inks add 5%-8% costs.

2. Inquiry Strategy: Request All-Inclusive Pricing to Avoid 25% Tax Shocks

- Demand Door-to-Door pricing: Insist suppliers explicitly list ICMS (state tax, 17%-18%), II (import tax, ~0%-14% by product), IPI (industrial product tax), and inland logistics fees. A FOB BRL 1,000 order can escalate to BRL 1,250-1,300 landed cost. All-inclusive pricing is foundational for accurate financial forecasting.

- Negotiate NRE fees: Clarify if engineering fees (BRL 150-500 for Gerber review/test jig setup) are creditable against bulk orders. Some factories offer “first-order NRE waiver” or “NRE refund for orders ≥BRL 5,000″—negotiable terms.

3. Delivery & Supply Chain: Leverage Local Resources to Shorten Lead Time by 40%

- Pre-qualify ANATEL certification: Uncertified factories risk 100% product seizure at launch—losses far exceed certification costs.

- Adopt dual-track strategy: For 5-10 urgent prototypes, prioritize local quick-turn factories in São Paulo/Campinas. Though unit costs rise 15%-20%, lead time shrinks from 3-4 weeks (including customs) to 5-7 days, eliminating customs uncertainty and accelerating R&D.

4. Order Consolidation: Dilute Testing & Logistics Costs by 60%

- Centralize procurement: Combine multiple R&D projects/design versions into one order. Merging 3 PCB panel types shares one flying probe test (BRL 100-200) and stencil fee (BRL 80-150), diluting fixed costs >60%.

- Build strategic partnerships: Sign quarterly/annual agreements with core factories. VIP clients often secure ~5% unit discounts, flexible payment terms (30-60 days), and priority scheduling.

5. Quality-Risk Balance: Customize Test Coverage to Optimize Costs

Grade test standards:

- Grade A (Critical Products): 100% electrical test + 100% AOI—highest cost.

- Grade B (Consumer Goods): 100% electrical test—moderate cost.

- Grade C (Functional Prototypes): Reduce flying probe coverage to 80% or test only first board—saves 15%-25% test fees. Document decisions in engineering files and clarify risk ownership.

How to Prepare Gerber Files for PCB Factory in Brasil?

Brazil Factory Gerber File Pitfall Avoidance Guide:

1. Layer Naming in Portuguese

- Action: Name circuit layers, solder mask layers, etc., using Portuguese or English + functional annotations

- Example: TopLayer.gbr → CAMADA_SUPERIOR.gbr

- Reason: Brazilian engineering teams prioritize native language processing, reducing communication errors

2. Mandatory Inclusion of IPC Netlist

- Action: Include .ipc or .net files in the compressed package

- Verification Tool: Use FreeDFM online connectivity checker (mandatory inspection item for Brazilian factories)

- Reason: Avoid production anomalies due to missing netlist.

3. Dual Annotation of Hole Attributes

- Action: Add a .txt specification file alongside drilling drawings (.drl)

- Content Template:

1UNIDADE: MM 2TOLERÂNCIA: ±0.05mm - Reason: Prevent aperture deviations caused by metric/imperial unit confusion

4. Mandatory Solder Mask Bridge Declaration

- Action: Use red text in README file to declare

- Declaration Content: SOLDER MASK BRIDGE ≥0.1mm (Reject if <0.08mm)

- Reason: Brazilian factories are highly sensitive to solder mask gaps; written declarations reduce disputes

5. Panelization Files Submitted Separately

- Action: Store V-cut/stamp hole design drawings in a separate folder

- Labeling Requirement: LAYOUT DE PANELIZAÇÃO – NÃO É PARA ETCHING

- Reason: Avoid factories misusing panelization files as circuit layers for production

6. Material Specifications in Filename

- Action: Include thickness, TG value, etc., directly in filenames

- Example: GERBER_ESPESSURA1.6mm_TG150_ANTIHALATION.zip

- Reason: Procurement departments archive materials by filename, accelerating material preparation

7. Remove Non-Standard Mechanical Layers

- Action: Check and remove all mechanical graphics except Dimension layers

- Reason: Local CAM software may misidentify auxiliary lines as etching paths

8. Pre-Submission Localization Checks

- Recommended Tools: Circuits Gerber Validator (for ANATEL minimum trace spacing validation)

9. Compressed Package Naming Conventions

- Action: Prohibit use of Portuguese diacritic letters (ç, ã, ó, etc.)

- Safe Naming Example: PCBV1_2024_BRASIL.zip

- Reason: Avoid server encoding errors in factory systems

Trends in Brazilian PCB Manufacturing 2026

Several measurable trends shape the direction of Brazilian PCB production in 2026. First, telecom demand keeps growing. Global telecom hardware spending is increasing at 5.2% CAGR, and Brazil’s broadband subscriptions rose more than 8% from 2023–2025. This growth lifts demand for multilayer boards and stable impedance control.

Next, automotive electronics continue to expand. Global studies show 8–10% annual growth in automotive electronics, while Brazil’s own vehicle production increased 6.1% in 2024. This trend drives higher use of FR4 multilayers and improved soldering performance for sensors and control modules.

Furthermore, renewable energy creates new PCB demand. The global solar market grew 23% in 2024, and Brazil ranks among the strongest solar markets in Latin America. Solar inverters and monitoring devices rely on durable PCBs, which supports steady local sourcing.

Additionally, surface finish preferences shift. ENIG adoption rises as fine-pitch components grow over 12% year over year. Buyers in Brazil also move toward flatter finishes for smoother SMT work.

Lastly, factories increase their investment in inspection. Global quality studies show 27% of PCB defects link to weak inspection, so more Brazilian manufacturers add AOI and better process control to improve stability.

Frequently Asked Questions of Fabricação PCB Brasil

1. Is Fabricação PCB Brasil good for fast prototype builds?

Yes, Many Brazilian factories support small batches, but the speed depends on their line load and material availability. Standard prototypes often take 7–12 days. For urgent samples, many designers use a global partner such as EBest Circuit (Best Technology), which can finish simple FR4 boards in 24–48 hours. This helps teams test designs without waiting for long local queues.

2. Do PCB factories in Brazil work with high-frequency materials like Rogers?

Yes, Most local plants focus on FR4 because it supports the majority of industrial and consumer projects. High-frequency materials such as Rogers appear less often due to limited supply. When engineers need RF boards, many send the job to a factory with experience in controlled dielectric materials, such as EBest Circuit (Best Technology). This approach helps maintain stable performance in telecom and radar builds.

3. Can Fabricação PCB Brasil support small-volume orders for startups?

Yes, Several Brazilian factories accept small-batch runs for early testing. This helps startups avoid high minimum order quantities. When teams need wider material choices or tighter tolerances, global factories offer more flexibility. Many engineers use a mix of both sources to keep development time short and cost balanced.

4. How can I reduce the cost of PCB fabrication in Brazil?

You can lower cost by improving panel use, choosing standard drill sizes, and reducing special processes. FR4 remains the most affordable material, so using common stack-ups helps. Many Reddit users mention that free DFM reviews from global factories like EBest Circuit (Best Technology) also help prevent reworks, which reduces hidden cost and supports smoother production.

5. What should I check before sending files to a PCB factory in Brazil?

Make sure your Gerber package is complete. Include copper layers, solder mask, silkscreen, outline, and drill data. Clear naming and clean outlines help factories start production faster. Engineers often say that a tidy file can save one to two days of back-and-forth communication. Factories with engineering support, such as EBest Circuit (Best Technology), help verify the files and point out risks before production begins.