The HTS Code for PCBA Board defines how an assembled circuit board is classified when shipped across international borders, and it influences tariffs, customs clearance, and trade documentation. The HTS Code for PCBA Board is not a single universal number; instead, classification depends on the boardâs function, industry, and application. Understanding HTS rules helps procurement teams avoid delays, unnecessary duties, or documentation issues.

What Is the HTS Code for a PCBA Board?

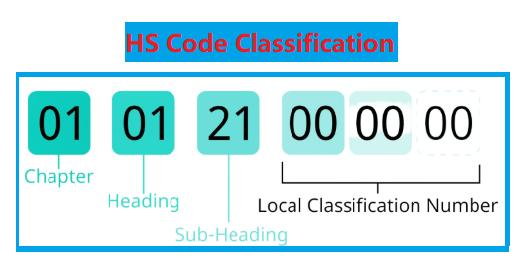

An HTS code, or Harmonized Tariff Schedule code, is a ten-digit classification number used in the United States to identify products entering the country. It is based on the international Harmonized System (HS), which assigns a six-digit universal description recognized by over 200 customs authorities worldwide.

For PCBA boards, the HTS code identifies the assembly as:

- A part of another device

- A functional module

- Or a complete unit, depending on its design and application

Customs authorities rely on the HTS system to decide tariff rates, inspection procedures, and trade control requirements. Because PCBAs vary widelyâfrom simple relay boards to high-density RF modulesâthere is no single category that covers every type.

In practice, classifying a PCBA means understanding what the board does, where it will be used, and whether it is considered a part, subassembly, or independent electronic device.

What Does HTS Code Mean in Electronics Manufacturing?

In global electronics manufacturing, the HTS code serves as the productâs legal identity during import or export. Engineers may view the PCBA as a technical assembly, but customs departments see it as a commercial item needing precise classification. The HTS code plays several roles:

- Product Definition

It describes the function of the board so that customs officials can categorize it correctly. This prevents confusion about whether the item is a raw material, a module, or a complete device.

- Tariff Assessment

Duty rates vary according to HTS classification. Some PCBA categories have zero duty, while others incur higher charges. Proper classification ensures accurate tariff calculation.

- Trade Compliance

Different HTS codes link to different trade obligations. A board containing RF functions, encryption chips, or power-conversion circuits may trigger additional review, depending on its HTS category.

- Logistics Efficiency

Shipments with correct HTS codes clear faster. Customs officers rely on the description matched to the code to process cargo with fewer questions.

For manufacturers and buyers working in the electronics industry, the HTS code connects engineering reality with global trade rules. It helps ensure that the journey from factory to destination follows legal and procedural standards.

Which HTS Codes Are Commonly Used for PCBA Boards?

While no single HTS code covers all PCBAs, several codes appear frequently across different industries. Each code corresponds to a particular function or device category. Below are some commonly referenced headings:

1. HTS 8538.90 â Parts of electrical control or switching equipment

2. HTS 8517.70 â Parts for communication devices

3. HTS 8504.90 â Parts of power supply or transformer equipment

4. HTS 8543.90 â Parts of other electronic apparatus

5. HTS 9032.90 â Parts of control instrumentation

The HTS number changes depending on:

- The boardâs purpose

- The type of device it supports

- Whether it is a finished functional module or just an assembly inside a system

Two PCBAs may look similar from a technical standpoint but belong to different HTS categories because their applications differ.

Common HTS Codes Used for PCBA

How to Determine the Correct HTS Code for Your PCBA?

Customs classification is based on a principle called âessential character.â In simple terms, this means customs officers want to know what the board actually does. This concept guides classification for most PCBA shipments. Here is a practical method used by importers, engineers, and compliance teams:

Step 1: Identify the primary function of the PCBA

Questions to consider:

- Does the board handle power?

- Does it communicate wirelessly?

- Does it control machinery?

- Does it process signals or data?

The function points to the relevant HTS chapter.

Step 2: Determine whether the board is a part or a complete unit

A PCBA that performs a standalone role may fall under a device category rather than a part category.

Examples:

- A complete motor driver board may be classified as a device.

- A temperature sensor PCBA that only works within a larger system is classified as a part.

Step 3: Check product similarity in customs rulings

The U.S. Customs Rulings Online Search System (CROSS) provides binding rulings for similar products. These examples help shorten classification time.

Step 4: Match the end-device industry

Different industries use distinct chapters in the HTS:

- Telecom â 8517

- Control instruments â 9032

- Power systems â 8504

- Consumer devices â several possible categories

Step 5: Consult with a customs broker

The importer has ultimate responsibility for classification. Because PCBAs vary so widely, many companies confirm their final selection with a licensed customs broker before filing.

Correct classification is a collaboration between engineering understanding and trade compliance expertise.

Industry-Specific HTS Code for PCBA Boards

1. Automotive Electronics

Many automotive PCBAs, such as brake control modules, lighting controllers, or infotainment boards, fall under:

- HTS 8537.10 or 8537.20 for control systems

- HTS 8512.xx for automotive lighting units

- HTS 8543.90 for modules not explicitly listed elsewhere

2. Telecommunication Products

Communication PCBAs commonly fall under:

- HTS 8517.70 (parts for telecom devices)

This includes Wi-Fi modules, Bluetooth modules, 4G/5G PCBAs, and router boards.

3. Industrial Automation

Factory-control PCBAs often use:

- HTS 9032.90 for controllers and sensor-driven assemblies

- HTS 8538.90 for switchgear control boards

4. Power-Conversion Systems

Power-related PCBAs often use:

- HTS 8504.90 for transformer and power-supply parts

5. Medical Devices

Boards used in medical equipment vary widely:

- HTS 9027.xx for measurement devices

- HTS 9018.xx for certain medical instrument parts

Industry-Specific HTS Code for PCBA Boards

Common Classification Mistakes Importers Make

Even experienced buyers, logistics teams, and engineering groups encounter challenges when classifying PCBAs. Misunderstandings occur because electronics are complex, and customs rules do not always match engineering terminology. Here are frequent mistakes that cause delays, reclassification, or unexpected duties.

Mistake 1: Using the bare PCB code for assembled boards

Some companies mistakenly assign HS 8534.00 to populated assemblies because the board structure resembles a PCB. However, customs distinguish clearly between bare boards and assembled modules. Using the bare board HS code for a PCBA often results in:

- Documentation mismatches

- Duty miscalculations

- Customs inspections

- Possible penalties

Mistake 2: Classifying based on physical appearance instead of function

A PCBA may look like another assembly, but its purpose may differ. Customs classification is function-driven, not appearance-driven. Two boards with identical shapes may belong to different HTS chapters if they serve different roles.

Mistake 3: Overlooking embedded features

Boards with communication features, encryption chips, or RF modules may fall under special categories. Importers sometimes classify these boards as simple electronic parts, which leads to customs corrections once officers identify communication functions.

Mistake 4: Relying solely on supplier suggestions

While experienced suppliers like EBest Circuit (Best Technology) provide accurate recommendations, the importer holds legal responsibility. A suggestion from a factory should be verified against customs rules and the productâs final usage.

Mistake 5: Ignoring parent-device classification

PCBA classification often depends on the device it supports. If the end product belongs to a specialized HS chapter, the PCBA may also follow that chapter. Importers sometimes choose generic HTS codes without considering this connection.

How HTS Codes Affect Tariffs and Customs Clearance?

The HTS code not only labels the PCBA; it determines how much duty the importer must pay. Different chapters and subheadings in the tariff schedule carry different duty rates. Selecting the correct HTS code ensures that the importer pays the proper amount and avoids unnecessary costs.

Tariff impact examples

- Many PCBA categories under Chapter 85 have 0% duty for U.S. imports.

- Certain PCBA parts for telecom equipment (8517.70) also have 0% duty.

- PCBAs classified under broader headings like 8543.90 may have variable duty rates depending on the exact subheading used.

Impact on clearance speed

Shipments with correct HTS codes:

- Clear customs faster

- Face fewer inspections

- Build a history of compliance with customs authorities

Incorrect classification may flag a shipment for review, especially if the declared value appears inconsistent with the code assigned.

Impact on compliance

Some HTS categories trigger special requirements. For example:

- Communication-related PCBAs may require detailed FCC-related documentation in some markets.

- Boards used in medical devices may fall under specific regulatory frameworks depending on the import country.

Correct classification reduces the likelihood of compliance complications after arrival.

HTS Code vs HS Code vs ECCN: Whatâs the Difference?

Engineers and buyers sometimes mix these terms, but each serves a different purpose.

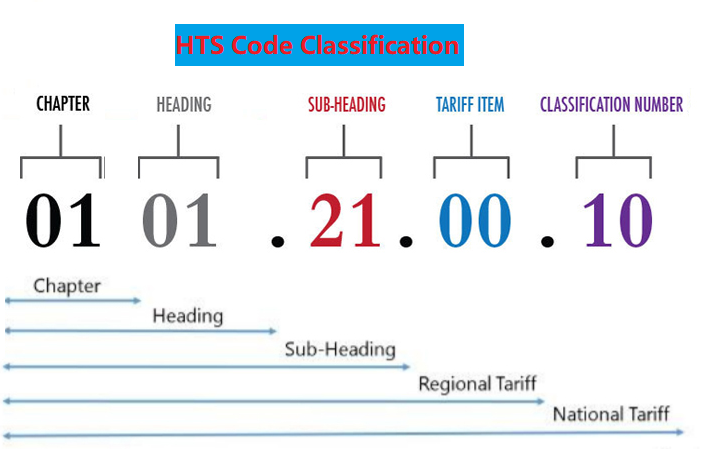

HS Code

- A standardized 6-digit code used globally

- Defines the basic category of the product

- Example: 8538.90 (parts for switchgear)

HTS Code

- The U.S. version of the HS system

- Extends the HS code to 10 digits

- Determines duty rates and U.S. customs procedures

- Example: 8538.90.6000

ECCN (Export Control Classification Number)

- Part of the U.S. Export Administration Regulations

- Controls export of sensitive technologies

- Completely separate from tariff classification

- Applies only to certain PCBAs, such as those with encryption or advanced RF capabilities

Many PCBA boards have simple ECCN classifications, but understanding the distinction is still important for compliance.

In summary:

- HS = international

- HTS = U.S.-specific

- ECCN = export control

All three may apply to a single PCBA shipment, depending on product complexity and destination country.

FAQs

1. Is there one official HTS Code for PCBA Board?

No, PCBAs are classified based on their purpose. Different applications use different codes.

2. Does every PCBA fall under Chapter 85?

Many PCBAs do, but not all. Boards for instruments, medical devices, or specialized equipment may fall under Chapter 90 or other chapters.

3. Can I classify a PCBA as a bare PCB?

No. Once components are mounted, the product becomes an electronic assembly and must follow its functional category.

4. Who is responsible for declaring the HTS code?

The importer holds the final responsibility, although manufacturers often provide a recommended code for reference.

5. What is the HTS code 8542.39.00?

HTS 8542.39.00 refers to electronic integrated circuits, specifically those not categorized as processors, controllers, memories, or amplifiers. This category is often used for mixed-function ICs or general semiconductor devices. It applies to standalone chips, not assembled PCBAs.

6. What is the HTS code 8504.90.6500?

HTS 8504.90.6500 is used for parts of power supplies, including transformer-based systems and switching power equipment. When a PCBA functions as a power-conversion moduleâsuch as an AC-DC or DC-DC converterâthis code is commonly referenced.

7. What is HS Code 8542.90.0000?

HS 8542.90.0000 covers parts of electronic integrated circuits and microassemblies. It is typically used for subcomponents or accessories related to semiconductor devices rather than complete PCBAs.

8. What is the HS Code 8543.20.0000?

HS 8543.20.0000 applies to signal generating equipment, excluding devices already classified under specialized communication categories. This code is often used for signal generators, test instruments, and electronic measurement modules.

9. What is the HTS code 8543.70.99?

HTS 8543.70.99 covers miscellaneous electronic apparatus and assemblies that do not fit into other more specific subheadings. Many general-purpose PCBA boards fall into this category when their function is not tied to telecom, medical, automotive, or power systems.

Tags: hs code for control board, hts code for circuit board, hts code for pcb, hts code for pcba